Alright, let me tell ya a little something about this thing called , which some folks say is a way to make a bit of extra cash if ya play it right. Now, don’t get lost yet – it’s really just a type of investment fund. Think of it like throwin’ money in a bucket, hopin’ it grows. But instead of just any ol’ bucket, this one’s tryin’ to double your money based on some big tech companies.

See, FNGG is what fancy people call an “ETF” – that’s short for exchange-traded fund, if ya care about such things. But what matters here is that it’s tied to somethin’ called the NYSE FANG+ Index. That’s just a list of some of the big names in tech – ya know, like Facebook, Amazon, Netflix, and Google – what they call the “FANG” stocks.

Now, this * thing ain’t just sittin’ there like a regular stock. Nope, it’s got a bit of oomph to it, tryin’ to give folks twice the daily returns of this FANG+ Index. So if those big tech stocks go up, FNGG’s s’posed to go up even more, by about 200%. But listen, if the stocks go down, well, that FNGG’s gonna drop even harder – double the fall, too.

People who buy into FNGG are lookin’ for short-term gains, not the long haul. This thing ain’t for keepin’ your money safe like under a mattress. No sir, it’s a way to ride the waves of the stock market, hopin’ to come out with more than ya put in.

- Real-Time Prices: You can see the price of FNGG as it goes up and down, all day long. The price shifts, dependin’ on how them big tech companies are doin’.

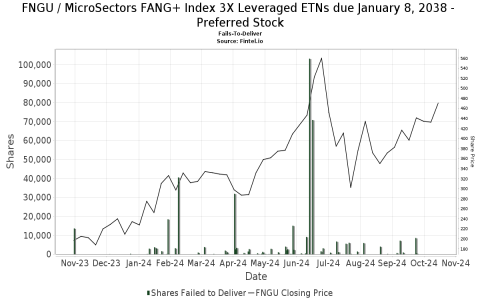

- Historical Charts: Folks who like lookin’ back to see how things went before can check charts of this FNGG. It’ll show the highs and the lows, so you can see if it’s been on a good streak or not.

- Dividends: Now, FNGG might toss ya a little extra money here and there in the form of dividends, but don’t get too comfy. Those dividends don’t mean it’s safe – they just add a lil’ bit extra.

Now, here’s the thing. Since FNGG is tryin’ to double the daily performance of those FANG stocks, it ain’t somethin’ ya wanna leave sittin’ too long. The way it works, it tries to match up to twice the performance each day, so it resets every day. That means if ya leave it in for weeks or months without checkin’, it might look a whole lot different than ya expected.

And let me tell ya, it’s a wild ride. If the FANG+ stocks have a good day, FNGG’s havin’ a better day. But if they’re down, FNGG’s down twice as much. So, folks who don’t like takin’ big chances, well, maybe this ain’t their cup of tea. But for folks lookin’ to jump in quick and hope for the best, * might just be somethin’ worth tryin’ out – but only if ya got the nerves for it!

Why People Buy FNGG

- Quick Profit Potential: Folks buy this fund thinkin’ they can make a quick buck when tech stocks are risin’. If things go well, you might see your money grow fast.

- Tech Enthusiasm: Some people believe in those big tech companies like they believe the sun’s comin’ up tomorrow. For them, buyin’ FNGG is like puttin’ their money where their mouth is.

- Risk Takers: Let’s be honest, this thing’s a bit of a gamble. Some folks just like the thrill of it, even if it means takin’ a hit now and then.

But lemme give ya a bit of advice, dear – ya best do your homework before jumpin’ in. FNGG ain’t your usual, sit-around-and-wait investment. Nope, ya gotta watch it like a hawk. Check them real-time updates if you’re serious, and keep an eye on the news about them big tech companies, ’cause their ups and downs will drag FNGG right along with ’em.

So, there ya have it – * in a nutshell. Not for the faint-hearted, but if ya got a good feelin’ and don’t mind takin’ a risk, it might just be worth a shot. Just remember, this here’s like bettin’ on a fast horse – it’ll take ya somewhere quick, but it might not be where ya hoped!

Tags:[FNGG, ETF, Direxion, NYSE FANG+]